News | Overview of New Transportation Legislation in 2018

Stop the VideoNews

by By Griffin Kantz, Alumnus, USC Price BSPPD 2017

Happy New Year to all!

Important legislation and policy changes related to transportation take effect this year at all levels of government. Here is an overview of the most important changes and what their impacts will likely be.

At the federal level, as of this week, transportation funding commitments for 2018 are still being shaped by Congress. Although overall funding for the Department of Transportation is anticipated to experience a decline from its 2016-17 threshold, funding for air, highway, and rail network improvements will actually increase. Despite a proposal by the White House to eliminate appropriation for the $500 million TIGER grant program (which assists in development of large-scale infrastructure projects), the program will continue to be funded through the 2018 fiscal year.

In anticipation of a national infrastructure bill leveraging private sector financing, the Department of Transportation is reorienting its grant funding algorithms to prioritize projects in rural areas, since rural communities would have greater difficulty nurturing public-private partnerships to fund future projects. In the short term, this may mean that federal dollars for urban infrastructure projects will become more competitive.

The new deductions of 2017’s Tax Cuts and Jobs Act (TCJA) took effect on January 1. The act eliminates two corporate deductions that served to incentivize commuting to work by bike and transit: a monthly $255-per employee deduction for providing parking or transit passes, and a monthly $20-per-employee deduction for covering maintenance expenses of employees who bike to work.

Employers may likely readjust their commuter benefit policies in response—not necessarily shifting costs onto those bike- and transit-riding employees, but providing fewer monetary incentives to commute to work by those means versus driving a car. This would impact local transit agencies who had leveraged the deduction to increase ridership and revenues, such as Southern California’s own Metrolink. Approximately 17% of that agency’s revenues are through corporate partnership programs in which employers sponsor their employees’ fares.

An earlier version of the TCJA would have eliminated private activity bonds, a special financing tool that underpins the financial stability of public-private partnerships by allowing private-sector organizations to receive revenues from tax-exempt public bonds issued on their behalf. This would have made any transportation projects funded through such mechanisms, such as the planned LAX rail connection, less feasible. This provision was not in the final version of the bill, however.

At the state level in California, new transportation grant funding cycles will begin as an outcome of last year’s Senate Bill 1 (SB 1), which raised gas and diesel taxes as well as annual vehicle registration fees to generate $5.2 billion in annual funding for backlogged transportation improvements statewide. Cities, transit agencies, metropolitan planning organizations, and other agencies will compete in the coming months for portions of this money pot to finance local projects, including the engineering, design, planning, and construction of such projects. The new fuel taxes came into effect last November 1, and the vehicle fees began on January 1. Many voters across California have vocalized strong negative reactions to these new taxes and fees, and a ballot initiative to repeal SB 1 in whole or in part may materialize in time for the November 2018 general election.

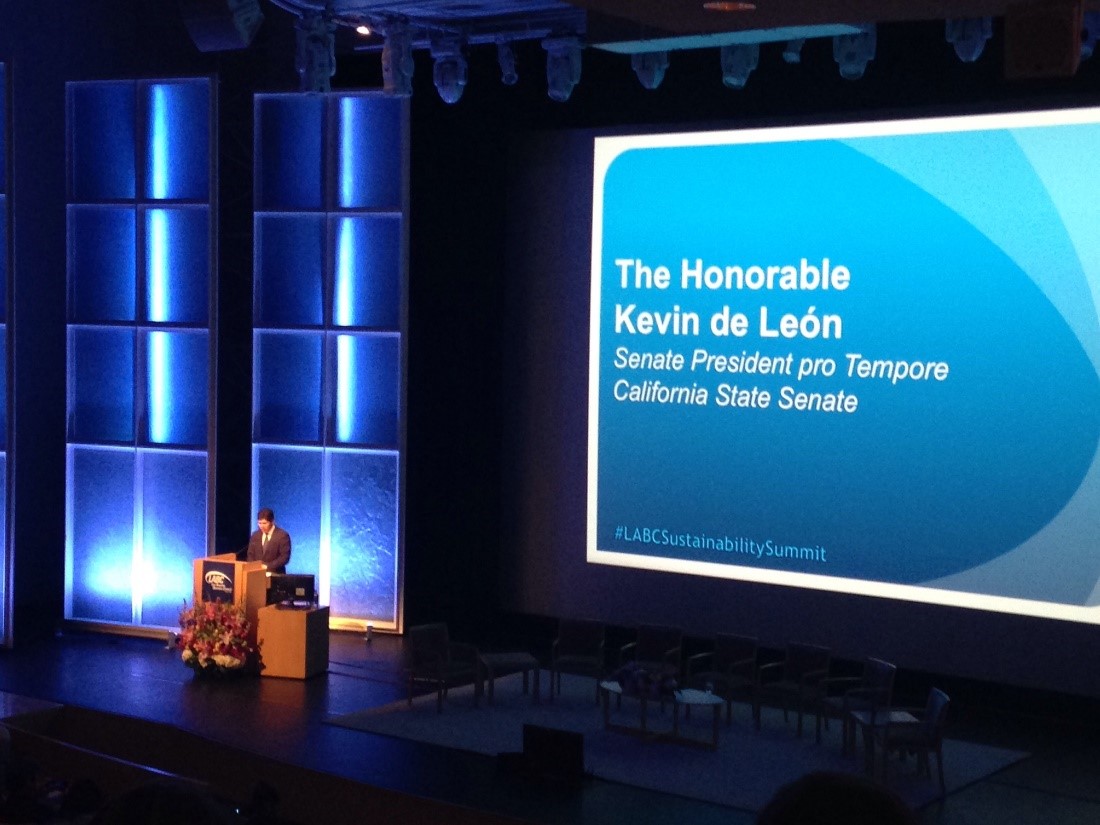

California Senate President pro Tempore Kevin de Le?n touching upon the projected benefits of Senate Bill 1 at the Los Angeles Business Council 2017 Sustainability Summit last April. Photo by author.

One particular state policy change will eliminate an outdated rule regarding the correct use of pedestrian crosswalks. Up until January 1, entering a crosswalk against a flashing red hand and a countdown timer was illegal—a fineable offense of up to $197—even if sufficient time to cross the intersection was available. This may be surprising information to some of our readers. That rule was legislated in 1957, before pedestrian countdown timers were common across the state. Almost 20,000 tickets were written for that infraction in Downtown Los Angeles alone between 2011 and 2015. Luckily, the California legislature voted to remove the counterintuitive rule last October. Pedestrians may now enter a crosswalk against a countdown timer, but must complete the crossing by the end of the countdown. Entering a crosswalk against a flashing red DON’T WALK or WAIT signal with no countdown remains illegal.

Another useful new state law prohibits local jurisdictions from banning or issuing fines for vehicles parked at broken parking meters or in parking centers with a broken payment kiosk. Parking in these locations may be restricted by ordinance to four hours per vehicle, but only if regulatory signs are posted. Lastly, beginning July 1, 2018, drivers for app-sourced rides including Uber and Lyft trips may not have a blood-alcohol content of 0.04% or more while a passenger-for-hire is present in their personal vehicles, meaning drunk-driving regulations would be twice as stringent as those for most other drivers.

At the local level, 2018 marks an important milestone: one decade before the 2028 Los Angeles Summer Olympics. The Los Angeles County Metropolitan Transportation Authority is preparing a strategy entitled “Twenty-Eight by ‘28” which outlines plans to complete as many major transportation projects in time for the games. Metro is aspiring to forge public-private partnerships in order to accelerate some of the larger-profile transit projects on its list.

As you can see, the start of 2018 is bringing with it many intricate changes to transportation policy. This creates an exciting opportunity for us at METRANS PSR to sponsor research exploring the effects of these changes! Perhaps that should become one of our new year’s resolutions.

About the Author: Griffin Kantz

Griffin Kantz graduated from USC in May 2017 with a Bachelor of Science in Policy, Planning, and Development, and was valedictorian of the School of Policy, Planning, and Development. Kantz was a student assistant at METRANS until graduation, and currently works as an Assistant Transportation Planner at KOA Corporation in Orange, CA. He can be reached at [email protected].

References

https://appropriations.house.gov/news/documentsingle.aspx?DocumentID=394975

https://www.congress.gov/bill/115th-congress/house-bill/3353

https://www.constructiondive.com/news/usdot-announces-500m-tiger-grants/504926/

http://www.latimes.com/nation/la-me-ln-transportation-tax-bill-20171129-story.html

https://la.curbed.com/2017/9/14/16308342/crosswalk-jaywalk-tickets-countdown-california

https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201720180AB390

http://www.latimes.com/politics/la-pol-sac-gas-tax-signing-20170428-story.html

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201720180SB1

http://ktla.com/2017/12/26/new-california-traffic-related-laws-taking-ef...

https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=20...

https://la.curbed.com/2017/10/6/16433026/metro-bus-transit-projects-acce...

News Archive

- December (1)

- November (6)

- October (4)

- September (2)

- August (3)

- July (4)

- June (3)

- May (7)

- April (8)

- March (11)

- February (8)

- January (7)

- December (7)

- November (8)

- October (11)

- September (11)

- August (4)

- July (10)

- June (9)

- May (2)

- April (12)

- March (8)

- February (7)

- January (11)

- December (11)

- November (5)

- October (16)

- September (7)

- August (5)

- July (13)

- June (5)

- May (5)

- April (7)

- March (5)

- February (3)

- January (4)

- December (4)

- November (5)

- October (5)

- September (4)

- August (4)

- July (6)

- June (8)

- May (4)

- April (6)

- March (6)

- February (7)

- January (7)

- December (8)

- November (8)

- October (8)

- September (15)

- August (5)

- July (6)

- June (7)

- May (5)

- April (8)

- March (7)

- February (10)

- January (12)